retail

industry

|

I don't even remember the last time I carried more than $20 in my wallet. A whole $20 can keep for a full week, without exaggeration. I put everything on credit, including: mass transit stored-value cards, fast food, and even candy bars at the local convenient store. And if they don't take my credit, they've lost my business. And here's another secret, I rotate my 6 credit cards, which means that by the time I max out card #6, I've paid off just enough of card #1 to always have plenty of credit at my disposal. Ah yes, it is indeed a brave new world of easy indulging, impulse luxuries, and cheap credit; but not for the merchants that accept credit.

In an unprecedented break from the powerful credit-facilitating oligopoly (Visa, MasterCard, Amex, Discover), merchants have sued to decrease the fees these bullies charge them to draw spendies like me. But seriously, if I do buy a candy bar, Duane Reade is looking at a $0.01545 charge for the service - maybe. ($0.08 goes to NYC; I'd sue the city first!) But, as a recent Wal-Mart lawsuit against the credit card industry demonstrates, those fractions of a penny add up - over $400 million annually to process Wal-Mart's 125 million charge transactions per week! (In the words of "Office Space" girlfriend Jennifer Aniston, the typical credit card company is "nothing but a penny-stealing, wannabe criminal man...")

The Hubbub About Fees

More merchants have sued since, but in an oligopolistic marketplace, there are no market incentives to alter the structure. Worse yet, the industry operates with so many layers (see Figure 1), each one independently working to get the next layer to charge more and more things, that its always easier to increase fees than lower costs. But what are these fees?

There are numerous fees: interchange, to pay off the banks; dues and assessments to pay the credit card associations, (Visa and Master Card are actually large associations owned by banks - and open to non-bank issuers like Capital One and MBNA - to disburse micro-lines of credit to the average citizen based on nothing else other than credit score vs. collateral like homes. Amex and Discover are both owned outright by other companies); right under this level are processors such as First Data, National Processing, and Vital, that provide the technological platforms to process transactions on behalf of the associations; and lets not forget the cuts that agents (also known as ISOs - independent sales organizations - or acquirers) take for actually getting the credit card machines into the stores and providing support. Many ISOs are large enough to have their own network of sub-agents (See Table 1).

But what irks merchants (and everyone else in the industry not directly benefiting) is that some acquirers are actually owned by processors, leaving little choice for certain merchants in how competitive their fees are. To make matters more complex, the bigger you are, the larger your processor has to be. The larger the processor, the lower your per-transaction fees get (and very likely, the more benefits you receive). And in a market with 4 million angry merchants (230 of which are the largest - where Wal-Mart falls into), processors are definitely feeling a lot of heat for their near-abusive fees and lack of healthy competition.

Will Spendies Ever Realize What They're Doing?

There are plenty of people like me: revolving credit (credit card debt) edged up 3.6% since Q1 of 2004 (1). Why? Our only answer is that the easier commerce becomes (besides credit cards, there are also other stored value payments from gift cards, paycheck cards, and debit cards [2]) and the more pretty, shiny things there are to buy, the more we consume. (U.S. advertising expenditures are projected to increase 5.7% in 2005 over last year; total ad growth was 4.8% since 2001 [3]). And since credit lines don't actually tap into our bank accounts, the act of "saving" - already a psychologically challenging concept for many of us - has been completely separated from the act of spending (which consumers appear completely inclined to do despite a widely reported stagnancy in U.S. take-home pay).

Then there's this whole housing mania. There's been a 4.4% increase in non-revolving credit (loans) since Q1 2004 and it doesn't appear to be abating (4). Although sane human beings (like economists) are taking a very passive perspective, speculating that this mania can't last forever, spendies aren't. The exact same exuberance that occurs in every bull market is occurring in housing and everyone is willing to finance it - again. As a result, the good times are indeed rolling and merchants are remaining (somewhat) submissive to the associations and their processors.

Consumers, though, will ultimately pay the most severe price. If a debtor makes a single late payment today, it is likely that the issuer underwriting the credit card will slap them with APRs as high as 40%! Worse, if they've got a history of late payments, etc, it could be higher. And this is the price we pay for issuers' willingness to endure higher risk by giving everyone credit. As often as history has demonstrated that consumers are practically averse to saving (more so today), issuers consistently believe that in the consumers' hierarchy of obligations, they still rank high enough to get their money back.

So why would banks keep giving us unreliable spendies all this credit we may just default on, seriously believing that they'll also get their 40% APR? Well, you would too, if you managed to pass a law that virtually guarantees you're going to make money no matter what: issuers celebrated as Bush signed The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 that makes filing for bankruptcy harder. Even death won't let you get out of debt after this thing goes into effect this October 17. A purer oligopoly never existed.

Next Steps for Merchants and ISOs

As this report is clearly empathetic to credit card holders (defenseless as they may be to their own irrational behavior) and the issuers, associations and processors all have consultants justifying newer and cooler ways to get their plastic to impulsively shoot out of my arm like Spiderman web-shooters, the only relevant take-away from this overview of the business must go to merchants and their ISOs:

Merchants

Alternative payment systems (i.e. eBay's PayPal, Google's upcoming electronic payment system) will go offline someday, giving the industry some much needed competition for your business. Until that day though, there's not very much that can be done to accept credit transactions on your terms. In the meantime, in order to offset the cost of accepting transactions, your volume has to pick up. If you're under 10 units, we suggest tactics like merchandizing and packaging executions that encourage multiple-item purchases.

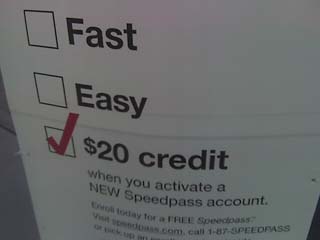

Some retailers, however, do have signage at the counter reminding consumers to be careful with their credit, as not only an innovative way to prevent too many returns (from credit purchases, since they still have to pay those fees, too), but as some alternative community affairs program designed to make the retailer a caring, thoughtful member of the community. It's also a moral decision, (as I've experienced first-hand from my own dry cleaner's utter defiance of modern technology in their store,) since credit debt is still taboo to many shoppers across the U.S., and as such, the merchant may not want to be responsible for helping financially strangle their customers.

|

ISOs

Service, service, service

shouldn't be confused with hire, hire, hire. The barriers to entry are fairly

low, so it is not uncommon to find ISOs utilizing agent recruitment strategies

like: "If he can string two words together, hire 'em to sell a box!"

Your training programs (not solely sales) must be institutionalized; your service

offerings simple, yet innovative; remember the customers: your support services

affect customers, and unsatisfied customers walk out of your merchants' shops,

and lost sales means lost processing and lost merchants; don't be scared to

alter your compensation between commission and non-commissioned; re-design your

merchant support processes (logistically, bottlenecks can occur if the receptionist

takes all the calls); and most importantly, perform constant mystery shops on

your agents. Bottom line is that you don't want to sell boxes, then forget who

you sold them to.

Write to Al Berrios

at editor@alberrios.com

Top

Footnotes

(1) The Federal Research; al berrios & co. analysis.

(2) The Incentive Show 2003 and Prepaid Markets Expo 2004

(3) Universal McCann's Insider's Report June 2005; al berrios & co. analysis

(4) The Federal Research;

al berrios & co. analysis.

Top

Related alberrios.com Sections

- al

berrios & co. Monitor - monitoring the country

Disclaimer:

The recommendations, commentary and opinions published herein are based on

public information sometimes referenced via hyperlinks. Any similarities or

likeness to any ideas or commentary from any other sources not referenced

is purely coincidental. al berrios & co. cannot control any results occurring

from advice obtained from this publication nor any opinion(s) conveyed by

any reader of this publication.

(c) 2005. All Rights Reserved. al berrios & company, inc. Published

by al berrios & co. This Report may not be reproduced or redistributed

in any form without written permission from al berrios & co., subject

to penalty.