|

|

|

Figure

1

|

|

|

Thirty more minutes later, annoyed and frustrated, I went to the front and proclaimed that I no longer wished to wait. "But the doctor hasn't seen you yet," said another nurse. "That's all right; I don't need to see him." And I left.

I hate my doctor. I hate the way he treats me. I really hate his swagger, his arrogance at how casually he and his nurses waste my time. But more than my doctor, I hate being subject to the insurance carrier I'm under. They pay 80% of the cost of whatever I visit my doctor for, but only if I visit that doctor. To reclaim my time back, I'd pay the full amount to visit another doctor. So, why bother paying my insurer if the one benefit I want - my time - I don't get?

The Escalating Cost of Insurance

Our observational analysis into the behavioral economics behind insurance has revealed two - and only two - reasons the cost of insurance is so high in the U.S.:

1) I visited the doctor's

office knowing exactly what I wanted, so who does this medical team think they

are wasting my time and my insurer's money telling me I needed more than what

I wanted? (In other words, the economic incentives between insurer and expense-maker

are conflicted. For example, in the case of the medical profession, the conflict

starts with a medical establishment that takes for granted that anyone with

internet access can research their symptoms and cures in seconds, effectively

reducing a doctor's role to advisor at least, project manager at best. Like

any "consultant" with "fixed knowledge" [![]() 1],

doctors want to collect ever-increasing sums of money for every second of their

"expert" time - just like a lawyer - and every procedure - just like

a project manager - and have no economic incentive to let you walk out of their

office quickly and without a procedure.

1],

doctors want to collect ever-increasing sums of money for every second of their

"expert" time - just like a lawyer - and every procedure - just like

a project manager - and have no economic incentive to let you walk out of their

office quickly and without a procedure.

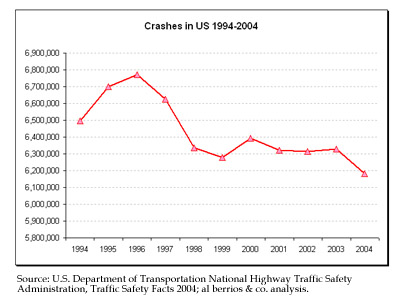

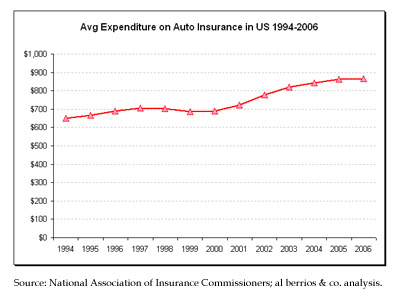

(In the case of auto insurance,

safer cars and safer roads does not a cheaper insurance rate get. In fact, despite

bigger and safer cars and roads, and 9% fewer fatalities, injuries, and property

damaged from its peak in 1996, insurers keep raising rates [![]() 2].

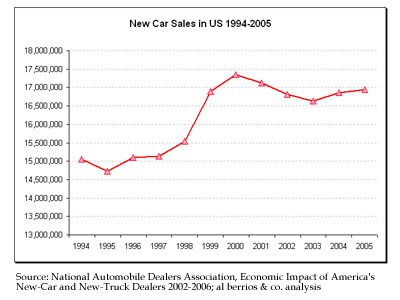

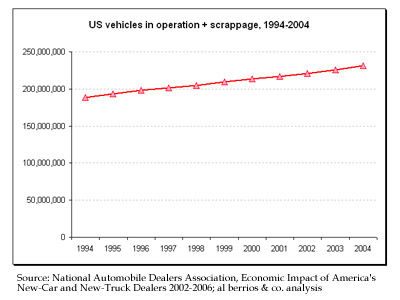

[Figure 1]. Incredibly, with an average annual increase of new car registrations

and insurance purchases of 1% and 20% more cars in operation during the last

10 years, [Figure 2], one has to wonder, why isn't insurance working the way

it's supposed to, where it decreases with every additional premium payer?);

2].

[Figure 1]. Incredibly, with an average annual increase of new car registrations

and insurance purchases of 1% and 20% more cars in operation during the last

10 years, [Figure 2], one has to wonder, why isn't insurance working the way

it's supposed to, where it decreases with every additional premium payer?);

2) The purpose of insurance is to reduce or eliminate the risk of paying any conceivable future expense - typically healthcare, but also natural disasters, unemployment, car accidents, and my property's safety - that I may not be able to pay for. But why is the individual incapable of foretelling their own future, thereby reducing their own risk? Understand that a person who lives a certain lifestyle anticipates certain life experiences from that lifestyle. To the extent which they adhere to that lifestyle, they eliminate certain variables from their life, and as a result of, also eliminate certain risks from their lives. This even includes "extreme" lifestyle enthusiasts. But try explaining that to an insurance salesman.

|

Figure

2

|

|

|

You'd Have To Be Nuts to Go Without Insurance - Right?

Ask an insurance industry person and they'll call an uninsured person a cadaver waiting to happen. Mention that being uninsured is by choice and they'll burst into near hysteria calling this person an insane wretch and wishing they suffer agonizing maladies so they can come to their senses.

The way insurance works (supposedly) is that when more people have it, the cheaper it gets for the whole group. Thus, if the cost of insurance goes up, it can be speculated that either a) less people have insurance, or worse still for the industry, more people are choosing to cut their insurance and remain uninsured or b) the insurance industry is arbitrarily raising its rates for no obvious reason.

To understand the phenomenon of why anyone would go without insurance, we analyzed the top 75 markets covered by FEMA's National Flood Insurance Program (NFIP).

Our original working theory on why folks just don't get insurance was that despite countless warnings about a neighborhood historically prone to flooding, many of Hurricane Katrina's hardest-hit victims in Louisiana had no flood protection. With over 40% of the country uninsured, we posited a possible explanation would be that no one with low income - like many of the victims in New Orleans, for example - could afford insurance, so despite repeated warnings, they just couldn't get flood insurance.

More importantly, there are other things those folks really need insurance for, like auto and health. But flood? In a generation, no amount of flooding ever caused enough damage to warrant insurance, and even if it did, that was a generation ago, so it couldn't possibly occur today, (a common behavior-based, decision-making flaw - basing decisions that influence your future on past occurrences.)

What we found was surprising. The markets with the highest rates of penetration for the NFIP, were in fact, counties in Louisiana, despite relatively high poverty levels (Figure 3). This is important because due to their low-income, many households may have received mortgages from non-bank lenders which don't require borrowers have flood insurance, unlike bank lenders. This means these residents sought out NFIP on their own.

The markets with the lowest rates of penetration for NFIP were in fact markets who could afford it, such as New Jersey counties. This is also important because with higher incomes comes greater accessibility to bank mortgages, who do require flood insurance when buying a home in flood-prone areas. This means these residents, possibly informed that a lower risk for major flooding actually exists in their neighborhoods, and more importantly, being able to replace any damage relatively easy, opted out of flood insurance - with the bank's consent.

Although a lot of the designations for flood-prone areas are dated - done over 20 years ago, developers lobby fiercely against updates for fear of decreasing property values - they still cover certain areas settled by affluent households. And although NFIP stats don't reflect whether households purchased flood insurance from other sources, it does offer a hint into the illegitimacy of the popular theories behind why there are so many uninsured Americans: a) the uninsured are simply ignorant about the "benefits" of insurance, and b) the uninsured are closed off from insurance products by language, income, or other factors.

Moreover, these figures validate our explanation why insurance continues to escalate beyond even middle-income's care.

|

Figure

3

|

|

|

Selling Health Insurance

Let's clarify: healthcare

and health insurance are two different things. And there are really only two

people on Earth who determine what kind of healthcare we should get: insurers

and the insured. Doctors, politicians, and certainly not employers - despite

their shouldering 60% of the cost of healthcare (![]() 3)

- do not have a say so in the healthcare patients receive.

3)

- do not have a say so in the healthcare patients receive.

(It is an irony then, that employers are maniacally forced into accepting this burden. In fact, employer-funded health insurance is such that laws have been enacted to assure they pay their "fair-share" - a Maryland law originally intended for Wal-Mart-sized businesses with over 10,000 employees in a state, but now being transported to New York and targeting businesses with 100 employees. At the May 5, 2006 Drum Major Institute healthcare forum at that capitalist bastion the Harvard Club, the extra-progressives were inspired with such vitriolic discussion against Wal-Mart's ways, you could be forgiven for assuming all that hootin' and hollarin' could actually make a difference. Look out for their sharp executive director, the youthful and energetic Andrea Batista Schlesinger, whose witty tongue can cut into any skin, even politicians'.)

Whether you buy insurance

directly from an underwriter (the companies who actually provide the financing

behind the insurance product) or a broker (the insurance salesman who distributes

the insurance products of various underwriters to the consuming public), there's

a standard 6% fee embedded into the premium for the broker, making it a juicy

incentive for hordes - 400,000 in 2004 (![]() 4)

- of insurance agents to sell insurance. Since the typical churn rate for agents

is between 20-40% and the barriers to entry relatively low, the cost of recruiting,

training, and incentivizing (with fatter commissions) all these brokers using

the traditional method - which hasn't changed in nearly a century - finds its

way into the end-user's pocketbook.

4)

- of insurance agents to sell insurance. Since the typical churn rate for agents

is between 20-40% and the barriers to entry relatively low, the cost of recruiting,

training, and incentivizing (with fatter commissions) all these brokers using

the traditional method - which hasn't changed in nearly a century - finds its

way into the end-user's pocketbook.

Thus, since the pursuit of Life, and by implication, a healthy Life, is an inviolable entitlement, when presented with a choice between health insurance and any other type of insurance, health will inevitably be chosen, at any cost. And having it handed to them by their companies and politicians has caused them to forget how to manage it and manage the industry that pays for it. (Never mind that the insured has, from the earliest days, had the power to control 50% of their own healthcare destiny.)

And handed to them is the best description. In the case of the NFIP, after Katrina struck, politicians wanted to retroactively apply the insurance to anyone who requested it, a heresy to insurers. Along the Mississippi, local governments have always compensated residents after major floods. Whenever the damage - whether wind, war, terrorism, or earthquake - afflicts a voting block in a democratic society, it's the democratic government's obligation to fix it. This makes a truly responsive democratic government very bad for business when you're an insurer (hence the ridiculously overwhelming lobbying strength of the insurance business.)

As a result, the insured make the business of eliminating risk one based entirely on how effective their insurers are at manipulating or even eliminating the information the insured needs to make a practical judgment on his own manageable risks and their role in that management.

(1) Berrios, Al, "Fixed Knowledge and Variable Knowledge and Valuing The Consultant's Time", Consumer Strategies Report April/May 2006

(2) Source: U.S. Department of Transportation National Highway Traffic Safety Administration, Traffic Safety Facts 2004; al berrios & co. analysis.

(3) Source: U.S. Census, "Income, Poverty, and Health Insurance Coverage in the United States: 2004"; al berrios & co. analysis.

(4) Source: Bureau of Labor

Statistics, U.S. Department of Labor; al berrios & co. analysis. For comparison,

there were 460,000 real estate brokers, 291,000 loan officers, and 281,000 stock

brokers.

|

|