|

|

|

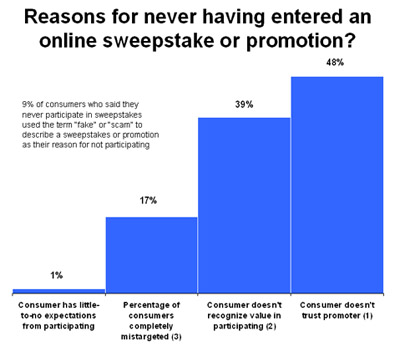

| Source: al berrios & co., Analysis of Consumer Sweepstakes Participation, Nov 2004 |

I'm your customer and according to mergers and acquisitions specialists, I have a lifetime value. That lifetime value is essentially added up with the lifetime value of every other customer your company has to determine what the entire enterprise (the organization I have a relationship with) is worth and despite customer defections, is still a key metric on which to base the value of your whole organization. But what exactly is lifetime value and is it guaranteed?

Lifetime value is how much money (from fees) a brand can get out of me during the length of my relationship with that brand. Thus, if I'm a subscriber to Comcast and I'm expected to reside at my residence anywhere between 3 to 5 years, during which I'm also expected to want to watch some sort of television or access the internet for my entire residency at that address, and assuming a monthly subscription rate of $100, that translates into a cumulative total of $3600 to $6000, or lifetime value.

Because the likelihood also exists that I may move to another location where Comcast is a dominant cable provider (a highly likely possibility considering Comcast's size), and I may completely be loath to switch to satellite or even a Bell-company-turned-cable-operator for my infotainment input, Comcast can confidently expect my lifetime value to potentially be in the neighborhood of $10,000. (Multiply that by 21.5 million subscribers and) Wow!, is there any wonder why Comcast is so arrogant when it comes to how it treats us subscribers?

That lifetime value can grow exponentially with every additional service Comcast can get me to cough up money for. So, now that they offer internet and phone service, they can theoretically yank as much as $200 bucks out of me - without any additional investment on their part, I may add. Thus, during a 10-year relationship, the length of my "lifetime" to Comcast, I'm potentially worth about $20,000 to them. (I am in the wrong business.)

Consequently, if it costs Comcast approximately $100 during those 10 years to upsell lil' ol' me on an additional service, it's more than worth it to them. Regrettably (for me), $100 buys a lot of phone calls, direct mail pieces, email blasts, on-air promos, and envelop stuffers, which, as a harried customer, I simply don't care for as it takes precious additional seconds to rip up and throw away.

Until the day when a master database can integrate all these efforts and notify marketers of the number of touch points they expose me to and with what frequency, relationship management is pretty much a hit-or-miss. To date, Comcast has no idea I'd rather go without watching television at all and use my cell phone exclusively than to have to give them another penny. But they continue to send me junk as though there's still a chance.

Credit card companies' understanding of upselling is even more… creative. Because paying off a debt is a lengthy endeavor, lifetime values can be measured in decades. But because withdrawing a single solitary interest payment from me - which, don't forget, fluctuates periodically and without warning, typically higher, even after you call to get it lowered - is not enough, credit card companies have become increasingly adept at trying to stick their hands in my pockets at every opportunity, including when I call to activate a new card, a process I'm forced to do every two or three years (Bank of America's re-activation is now annual, a gimmick I'm sure a consultant suggested to BofA's glee and delight).

Understanding Behavior For More Effective Upselling

So how should a brand upsell me? For starters, understand that being indebted to a company does not prompt me to want to owe more. Second, understand the nature of your relationship with me; in other words, why exactly do I use your brand?

Merely accepting the fact that the customer does use the brand isn't a requisite to assume they'll buy anything you have to sell. So, if the customer "hires" your brand - a favorite term for understanding the nature of a brand's relationship with their customers - if the customer hires your brand for say, a cheap meal, as opposed to what the meal actually is (i.e. hiring your brand because they love burgers), then you can assume that an additional product at an additional price during the same transaction may not be the best way to get another dollar from your customer.

A better approach may be to offer other selections (really, any selection if the customer has hired your brand for price) at similar prices. This maintains your brand's relevancy to that customer that just wants a cheap meal. Thus, if I see Comcast merely as a means to an end - the pipe to the internet, for example - positioning itself as an all-purpose communications gateway for all my communications needs is a mispositioning and isn't going to prompt me to be upsold.

On the other hand, if Comcast positioned itself as the commodity they are - and an alternative to other viable choices at that - they'd invest more in their customer service and I wouldn't mind so much paying the extra dollars to have them offer me more means to accomplish my communications ends.

Let me emphasize that no investment pays off better than customer service training. Thinking of this as an outsourceable function is ludicrous. Better to outsource accounting work as this doesn't require courtesy, than a critical point of contact between you and those who give you their money.

Finally, when trying to

upsell me, consider that I don't need any extra incentives like free trials

and bonus points to use your brand. If I really needed it, I'd use it. Research

conducted by this firm on rebate and incentive programs (![]() 1)

shows that approximately 17% of your consumer base utilizes any rewards programs

whatsoever, and they repeat this behavior with every offer they encounter from

any brand. This means that their overall lifetime value is drastically less

than that of consumers who actually pay full price but never take advantage

of specials. And that means that you're horribly wasting money trying to convince

these "rewards-groupies" to try your brand since that's all they do,

try it, fully aware and anticipating the next company that comes along to offer

your brand to them again for free.

1)

shows that approximately 17% of your consumer base utilizes any rewards programs

whatsoever, and they repeat this behavior with every offer they encounter from

any brand. This means that their overall lifetime value is drastically less

than that of consumers who actually pay full price but never take advantage

of specials. And that means that you're horribly wasting money trying to convince

these "rewards-groupies" to try your brand since that's all they do,

try it, fully aware and anticipating the next company that comes along to offer

your brand to them again for free.

Keeping in mind these insights

will guide your upselling program from an aggressive arm-pull, obnoxiously abusing

my time and disrespecting my intelligence, to one where I'm permitted to evaluate

you among all my other choices, at which point, you differentiate yourself with

real value customized to me, rather than some generic offer across a consumer

segment merely classified by age, ethnic background or politics and padded with

incentives parading around disguised as valuable offers worthy of my attention.

(1) Source: al berrios

& co., Analysis of Consumer Sweepstakes Participation, Nov 2004

|

|