|

|

The Working Theory of Content

By Al Berrios

|

|

Pirates? What pirates? No pirates around here... |

In a hysterical retelling of how the entertainment industry’s most prominent, high-tech, anti-piracy mechanism – MediaDefender – was hacked by some 16 year old in his basement on his free time on a 5 year old Hewlett Packard computer in February’s Portfolio magazine (

Stunningly, in two widely cited studies, also quoted in the article, the quantity of content bought has either no correlation to downloading free content or may even increase quantity bought, depending on which study you believe. And that’s what’s funny about the whole situation; rather than believe the research, anecdotes, or even coming up with a new business plan, content producers have resorted to aggressive defense and attacks on anyone with a computer and a modem they suspect of stealing content.

The Trajectory of Consumerism in the Diversified Media Industry

So how did an industry end up battling its consumers? It seems oddly unusual that the very people the industry is trying to sell to (demand) it’s also trying to hurt. After all, these evil villains are actually buying more music, not less, so they’re still living up to their part of the deal. Let’s begin with the simple concept of demand.

Historically, the relationship has always been driven by the supplier; they make what I previously made from scratch and I buy to avoid having to make it myself. But during the course of this relationship, something changes. Other suppliers enter the market, or the good improves. Suppliers then start offering differentiating things, like customer service and competitive pricing. But even this fails to keep customers happy. They’re no longer listening to you. They’re starting to lead the conversation, making demands of suppliers that they can’t meet. This subtle shift is the new demand curve – consumerism. And consumerism requires a whole new game plan.

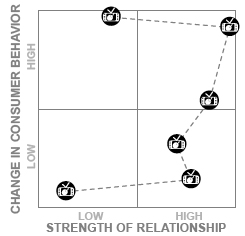

| Figure 1: Trajectory of Consumerism in Entertainment Diversified Industry |

|

| Source: Strategic Positioning for Managing Consumerism in the Health Insurance Industry, a comparative study of complex and “messy” industries by al berrios & co., Nov 2007 |

In 2002, al berrios & co. developed a model of consumer risk to better understand the rational and irrational factors that determine an organization’s risk of losing customers due to change in the organization’s business model (![]() 2). Our model works by combining the various elastacities of a brand (price, cross, and income), select demographic information, and proprietary research into consumer’s sentiments toward a brand or industry’s value, ethics and ideologies.

2). Our model works by combining the various elastacities of a brand (price, cross, and income), select demographic information, and proprietary research into consumer’s sentiments toward a brand or industry’s value, ethics and ideologies.

To apply the consumer risk model to the entertainment industry, we came up with a 100-year timeline reflecting significant events during the industry’s history (![]() 3) and divided the timeline into 20-year cycles through 2020. Then, taking into consideration the events that defined the industry during each generation, we estimated where each generation of consumers would be plotted in a 4-quadrant matrix. What we then had was a trajectory originating in the lower left quadrant, shooting far away into the lower right, then rising higher and higher into the upper right, until it reversed course, settling into the highest segment of the upper left quadrant, a trajectory more radical than in any other industry we’ve studied (See Figure 1).

3) and divided the timeline into 20-year cycles through 2020. Then, taking into consideration the events that defined the industry during each generation, we estimated where each generation of consumers would be plotted in a 4-quadrant matrix. What we then had was a trajectory originating in the lower left quadrant, shooting far away into the lower right, then rising higher and higher into the upper right, until it reversed course, settling into the highest segment of the upper left quadrant, a trajectory more radical than in any other industry we’ve studied (See Figure 1).

What this means is that the risk of a player in the industry losing consumers was relatively low during the first 60 years, then it notched up into medium risk, and finally high risk. The trajectory of consumerism can be translated into an industry’s increasing risk of not paying attention to demand, and consequently demand becoming less responsive to and more independent of its relationship to supply.

And with each shift, the industry did not keep up.

The Structure of Diversified Entertainment Over the Last 100 Years

To understand this unusual phenomenon (the resistance to adapting to consumerism in their industry), we used another analysis method called Business Model Anthology Analysis (BMA), an innovative perspective to quickly determine the form commerce has taken to facilitate a transaction, to see how the industry has changed over time. This methodology works by mapping the ideally simplest relationship between sellers and buyers in multiple industries or over time, to identify similarities and/or distortions. The goal is to quickly identify what an organization or industry is not doing or doing wrong.

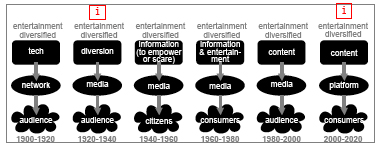

Thus, on the same timeline, we identified and labeled the seller – channel – buyer relationship in the industry across 100 years based on the same significant events (Figure 2). The first set of differences we find over time is how the supply of content has changed. It changed based on how the industry perceived its audiences up to the 1960s-1980s generation, when the risk of losing audiences increased for the first time. These changes reveal a fascinating challenge with the industry’s ability, or lack thereof, to control the supply of content.

| Figure 2: Business Model Anthology (BMA) Analysis of Entertainment Diversified Industry over 100 years |

|

| Source: Strategic Positioning for Managing Consumerism in the Health Insurance Industry, a comparative study of complex and “messy” industries by al berrios & co., Nov 2007 |

This may explain how the reintroduction to technology as an innovation in the current generation has collapsed the historic barriers to entry for new suppliers by permitting anyone, regardless of marketability or profitability, to enter the industry. Thus, despite the industry’s efforts to retain control of its model, forces outside of its control have changed the nature of its supply, which consequently altered its consumerism trajectory irrevocably into a new paradigm where, contrary to popular industry lore, have left the industry with more options than they had in previous generations, when business was so good no changes were necessary.

Additionally, it should come as no surprise to anyone familiar with the industry that over the span of 12 decades, the industry has innovated (![]() 4) only twice: in the 1920s, when the “business” changed from technology to content and in the current generation, when it reverted back to technology.

4) only twice: in the 1920s, when the “business” changed from technology to content and in the current generation, when it reverted back to technology.

Both instances of innovation saw severe disruption in how the established players profited from the current model; but the first shift was extremely different than the one being experienced by the industry today because there was very little risk in losing audiences to competitors, and, if you recall from Figure 1, because consumers’ relationships with the brands that offered them these choices were at their strongest. Today, the risk of losing consumers to alternatives is extremely high, leaving the industry with the option of either investing more or less in supplying the market.

Working Theory of Content

Once we understood the nature of the demand in the Diversified Entertainment industry, we were still interested in understanding how organizations can address those demands not merely by tweaking their supply, but by truly addressing the new demand paradigm. Thus, we propose the following formula for the industry to understand the opportunities in their business model.

t = time

h = hours

c = cost of content

t(h) = length of time

m = cost of accessibility (by medium)

u = utility

t(u) = speed to relevancy

p = (practically guaranteed) profit

Thus,

(c * t(h)) + (m * t(u) + (t(h)(u)-1)) = p

In other words,

(Choice of Content + Time of Consumption * Time to Consume) + (Choice of Medium * Speed To Relevancy) + Time Until Irrelevance = How to profit from evolving audience preferences

Most of the elements of our formula are already known about the way consumers consume content (![]() 5); except the speed at which consumers are able to extract some sort of utility from their content and the length of time it stays relevant. (This is the most variable factor, since it depends on things like personal skillsets, resources, events, networks, and urgency.)

5); except the speed at which consumers are able to extract some sort of utility from their content and the length of time it stays relevant. (This is the most variable factor, since it depends on things like personal skillsets, resources, events, networks, and urgency.)

Thus, now that we have a more comprehensive picture of where the entertainment industry went wrong, we can now explore how they can apply this new thinking to re-orient their business models.

Exploiting the Theory – Investing Less in Content

Historically, the trend in the entertainment industry has always been to invest larger sums of money on content perceived as guaranteed successes, success often attributable to the participation of scarce (and consequently, pricey) actors, directors, and/or brands. This "cost-spiralling" system has evolved to rely on complex and imperfect, multi-platform, global, advertiser-supported, tiered-fee environments in order to extract maximum revenue at every stage of the content’s life-cycle.

Erroneously, low-cost content that yields high return is widely acknowledged to be the exception, not the rule, since the industry prefers only high-quality to draw wide enough audiences to profit from content, a preference classifiable only as "gambling" on the future of the business, albeit, gambling with experience on your side.

Since the introduction of the “long-tail” (![]() 6), it’s become more apparent that there’s an audience for every type of content and a model to extract profit from that niche audience. But what the entertainment industry is (seemingly) neglecting is the lower-cost of storage media, production, and editing and the wider-availability of creative talent to produce content and affordable technology to enjoy content any way the audience wants, from cell phones to digital projectors. Combined with the long-tail audience, these unique phenomena facilitate a new model that, counter-intuitively, requires less investment in content production, rather than more. This thinking is supported by the Consumerism Trajectory plotted in Figure 1.

6), it’s become more apparent that there’s an audience for every type of content and a model to extract profit from that niche audience. But what the entertainment industry is (seemingly) neglecting is the lower-cost of storage media, production, and editing and the wider-availability of creative talent to produce content and affordable technology to enjoy content any way the audience wants, from cell phones to digital projectors. Combined with the long-tail audience, these unique phenomena facilitate a new model that, counter-intuitively, requires less investment in content production, rather than more. This thinking is supported by the Consumerism Trajectory plotted in Figure 1.

In other words, if at one spectrum, one has high-quality, high-cost productions distributed via multiple channels and at the other, low-quality, user-generated content distributed via limited channels, the key to halting the industry’s collapse is to meet in the middle with medium-quality, pro/am-generated, multi-tiered productions, targeted and distributed digitally to niche audiences, with increases in investment determined by a sliding scale based on an entertainment brand’s ability to attract wider audiences (so, if the audience for a brand starts out at 1000 people, every time it crosses a new benchmark in the number of people enjoying that content, like 10,000, or 1,000,000, investment into producing that content would go up by 5% - to - 10%, since presumably, the larger audience is generating larger revenue).

To some extent, this is the way this system currently works; however, it isn’t based on any other analysis except “instincts” and number of impressions, a methodology that doesn’t care for revenue generated by paying audiences. Consequently, in order to get to the point where content is produced to profit from niche audiences, you’d need a system to grant access to your content when consumers pay (AOL 1.0, iTunes, Netflix, Hulu are but a few companies that set themselves up as Long-Tail gateways), instead of relying solely on what advertisers pay; and a system which also lowers costs, from production (thanks, Apple!) to marketing (online marketing, anyone?) Not surprisingly, these systems all exist today, whether the industry wants to use them or not.

Footnotes

(1) Pirates Can’t Be Stopped, http://www.portfolio.com/news-markets/national-news/portfolio/2008/01/14/Media-Defenders-Profile

(2) Berrios, Al, "Understanding Consumerism", http://www.alberrios.com/c/0308consumer.html

(3) The diversified entertainment industry is a relatively recent agglomeration, less than 10 years old. For the purposes of this analysis, we treated all companies that produce and deliver content between 1900 and 2020 as part of the diversified entertainment industry.

(4) We overlayed another proprietary analysis tool called innovation ratings on top of our BMAs to spot innovations in the industry.

(5) The trick here is in the erroneous correlation between the content consumers consume and the media via which they consume content through. This discussion distinguishes and discards media as a consumption choice, preferring instead to focus on the content. The reason for this distinction is convergence, the accessibility of content via any medium, negating the media argument from our perspective.

(6) Anderson, Chris, “The Long Tail”, Hyperion, 2006

|

|