|

|

By AL BERRIOS

|

|

Off

Track

|

German (pronounced Herman) sputtered into my office for the first time on September 21, 2006. He sat down by my desk opposite me full of anxiety, frantically shuffling his bundle of papers, no doubt still suffering the after-effects of having to navigate the security in my lobby that made him feel more like a delivery boy (of 45) than a client.

German was in fact a former business owner (with 4 other partners) whose 3-month old business went bankrupt after 9/11 and the sudden death of his brother, the founder who had the best credit score and business savvy. During the subsequent 5 years since, he'd been busily untangling the mess that was a loan-sharked, immigrant-owned, transportation business and paying off the debts his brother left behind (all with interest rates of between 80%-to-150% of the loan amount). He had gotten to me because he had heard I was offering counseling in his native Spanish language and figured I may be able to point him the right direction.

His severely-limited English and normally unkempt presentation were either the cause or result of an experience that clearly aged him, for he also hadn't declared bankruptcy, a pointless exercise when all your debts are to predators. Sitting before me, I could tell that he couldn't afford new clothes, or even to launder the clothes he owned on a regular basis (assuming he even cared about his appearance at all).

German proceeded to frenetically explain that he needed funding to relaunch the transportation business. To me, it sounded like a last-ditch (and futile) attempt to salvage some meaning from his existence. (To him, the fact that he was seeking funding outside the traditional loan-sharks he'd always thought were his only available source of funding was a huge step.)

He had called Lehman College (part of CUNY) for free business help and government programs for business assistance. What he received were free articles (which he read) on starting a business and getting a loan (in Spanish), including newspaper clippings. The articles had convinced him that all he needed was enough money to repurchase a bus to get back in business, despite his dread of the 20-hour shifts he had to put in to make it worthwhile (miraculously, he still owned the rights to his routes and a commercial driver's license). This only really served to overwhelm his soul and dampen his spirits since he was averse to going to a bank for a loan, believing his finances were a toxic wreck for any bank; he'd remain in a depressive state for 3 full years, which prevented him from maintaining any full-time employment.

Of course, he had no business plan ("Business-Que?!"); he presented me with a deteriorating folder of legal documents and what appeared to be the "notes of a genius"; he had no computer, either. He was absolutely uninformed about anything other than hard, blue-collar labor. But German did possess something extraordinary.

With a little probing, I discovered, to my amazement, that German had, in fact, mapped out in his head a whole other venture in the "multi-service" category for the neighborhood he lived in (Washington Heights in New York City, a predominantly Dominican neighborhood). A multi-service is a retail location with multiple, unrelated revenue streams, such as money transfers, international calls, tax preparation and filing, etc.

The venture concept was actually the culmination of the 22 different odd-jobs he'd held since arriving in this country, in liquor stores, bodegas, delis, everywhere. He'd actually figured out what was wrong with all of them and felt that if he were to get into that business, he could make it work. He even had a location picked out; he had friends everywhere in his community who'd lend a hand; and more importantly, he had an accounting and economics degree from his home country, so he could add (better than most Americans I know, too). Eureka! We found a smile!

German was a natural entrepreneur, but until that moment, he'd only uttered his ideas to his sister. It's not that he didn't trust anyone enough to talk about it; it's just that no one had ever asked. And I'm sure had he found an opportunity to share his multi-service idea with one of his regular uptown buddies, he would have been dismissed as a pie-in-the-sky dreamer.

The more he told me, the more enthusiasm in his voice; a tear welled in his eye from elation. German's idea was actually good, workable, and had more potential than his transportation idea, but without a single word of encouragement in the prior 6 years, he'd never realized that it was within his ability to achieve. The trick was how he would be able to understand his entrepreneurial streak and ability after his prior catastrophic start-up ordeal?

Welcome to entrepreneurship. It's not sexy. It's not liberating. It's not bravery. And in a survey of exclusive interviews with a selected 59 New York-area entrepreneurs, we analyze the classes, levels, and lives of entrepreneurs as no one ever has utilizing our firm's behavioral economic models to peel away some of the myths associated with the greatest economic engine and anti-poverty mechanism human history has ever known.

Levels of Entrepreneurship

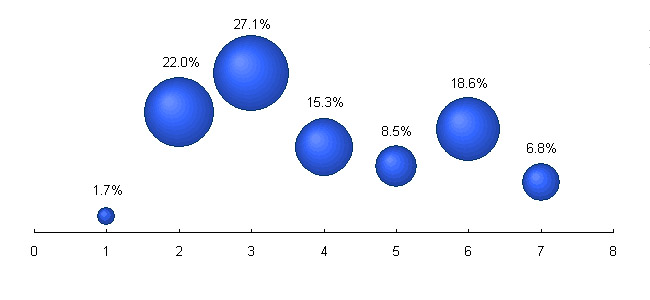

| Figure 1: Concentration of Entrepreneurs in Survey by Levels |

|

|

Source:

al berrios & co.

|

In our own analysis

of free small business consulting services (![]() 1),

we identified 8 levels of entrepreneurship: (1) becoming motivated about

an idea, (2) exploring the idea, (3) modeling a business behind the idea,

(4) funding the business, (5) launching it, (6) "auto-pilot" or

when the business can operate without the entrepreneur's presence for a

prolonged period of time, (7) exploring developing business-level strategy,

and (8) exploring developing corporate-level strategy. We arranged our entrepreneurs

based on these levels to offer a clearer picture of the wide spectrum of

entrepreneurs in the New York City area (see figure 1).

1),

we identified 8 levels of entrepreneurship: (1) becoming motivated about

an idea, (2) exploring the idea, (3) modeling a business behind the idea,

(4) funding the business, (5) launching it, (6) "auto-pilot" or

when the business can operate without the entrepreneur's presence for a

prolonged period of time, (7) exploring developing business-level strategy,

and (8) exploring developing corporate-level strategy. We arranged our entrepreneurs

based on these levels to offer a clearer picture of the wide spectrum of

entrepreneurs in the New York City area (see figure 1).

The highest concentration of entrepreneurs, at 27%, are Level 3 entrepreneurs, who are in the midst of working out their business idea. The second highest concentration, at 22%, are folks exploring whether or not they should get into the business they're thinking about, including what, if any interest, skills, and resources they possess. (Note that just 22% of all entrepreneurs in our group did not possess any resources, including cash, contacts, or reputation prior to initiating their entrepreneurial ambitions.)

The third highest concentration at 19% were entrepreneurs whose businesses had already been launched and they were already committing to their venture a full-time schedule (whether or not they were employed elsewhere). The fourth highest at 15% were those seeking funding; at 9%, fifth were those in the midst of an actual launch; and at 7%, sixth were those in the midst of an expansion.

The least concentration in our group at 2% were those merely exploring the possibility that they could be entrepreneurs, (which, in the opinion of this survey, is representative of the various government and non-profit programs that aid unemployed, transitioning workers evaluate whether or not it would be better for them to launch a business instead of wait for a job to come along.)

There are no pre-requisites to be categorized in any of these levels; for example, not every entrepreneur in Level 2 was actually committed 100% to launching a venture - despite the time it takes to explore one's resources and abilities - due to more immediate needs such as finding a job and a stable income to support a family. However, at Level 2, entrepreneurship was still a viable option.

Incredibly, all of the entrepreneurs at Level 4 (who needed funding before launching) had resources available to them (possibly the result of having passed through all of the prior levels and accumulating what they needed to get to level 4). More astonishing were the 78% of Level 4 entrepreneurs who were launching pure service businesses, which don't always need funding (or other capital resources) to launch, depending on the service. More than anything, this provides a clearer picture as to how much harder it must be to bank with these entrepreneurs, considering they're more equipped to negotiate on their terms, the vast competition in the New York market for their business notwithstanding. Note that not all of Level 4 entrepreneurs sought advice on finance, but also marketing and legal issues.

Classes of Entrepreneurs

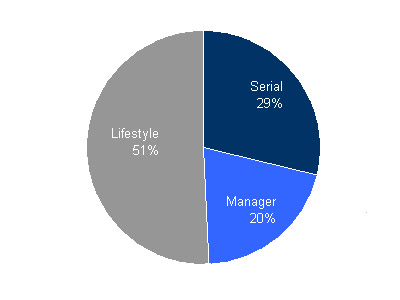

| Figure 2: Classes of Entrepreneurs in Survey |

|

|

Source:

al berrios & co.

|

In a report classifying

entrepreneurs (![]() 2),

we identified three classes of entrepreneurs: the serial entrepreneur (thinks

big), the entrepreneurial manager (thinks rich), and the lifestyle entrepreneur

(thinks survival). Although we asserted that entrepreneurs can be classified

as all three to varying degrees, entrepreneurs do skew towards one more

than the other. Classifying our group of entrepreneurs solely into one class

each, this is how our group worked out: serial - 29%; manager - 20%; lifestyle

- 51% (see figure 2.)

2),

we identified three classes of entrepreneurs: the serial entrepreneur (thinks

big), the entrepreneurial manager (thinks rich), and the lifestyle entrepreneur

(thinks survival). Although we asserted that entrepreneurs can be classified

as all three to varying degrees, entrepreneurs do skew towards one more

than the other. Classifying our group of entrepreneurs solely into one class

each, this is how our group worked out: serial - 29%; manager - 20%; lifestyle

- 51% (see figure 2.)

A lifestyle entrepreneur,

who very likely has no other alternative than to be an entrepreneur if he

wants to put food on his family's table, consists of two groups: 70% with

resources, 30% without. This corresponds to the Census' earliest available

data on the characteristics of entrepreneurs (![]() 3).

The odd part is that for 60% of our group, the current venture is a first

career; in other words, no rep, no contacts.

3).

The odd part is that for 60% of our group, the current venture is a first

career; in other words, no rep, no contacts.

The likely result of

this quirk is two-fold and broad in trend. Firstly, as we've speculated

before (![]() 4),

entrepreneurship is cyclical by generation. Today's boomers were born into

a society cared for by "Big Brother". There were plenty of jobs

and plenty of people to fill them. Their parents, on the other hand, were

entrepreneurs. Boomer's grandparents were the ones who migrated with the

economy, from agriculture to industrial, but it was their great-grandparents

who launched the industrial economy.

4),

entrepreneurship is cyclical by generation. Today's boomers were born into

a society cared for by "Big Brother". There were plenty of jobs

and plenty of people to fill them. Their parents, on the other hand, were

entrepreneurs. Boomer's grandparents were the ones who migrated with the

economy, from agriculture to industrial, but it was their great-grandparents

who launched the industrial economy.

Today, it's boomer's kids who have launched the information, knowledge, and service economy. They're better "informed", more acclimated with technology and how efficient and productive it makes them, and more prepared to take a risk, since unlike their parents, they're living in a society that will easily outsource their jobs without prejudice. Whether or not they have more money or "opportunities" than their parents appears to be irrelevant. And this trend applies to entrepreneurs of all backgrounds. (Seventeen percent of our group was like German, speaking little-to-no English.)

First, The Business Plan, Then The Loan

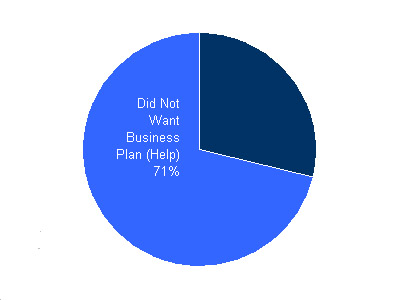

| Figure 3: Survey Population |

|

|

Source:

al berrios & co.

|

Of all the entrepreneurs surveyed, it may surprise you to learn that not a single one suggested initiating their venture in massive debt. So it comes with a degree of shock how consistently every single advisor our entrepreneurs will encounter will suggest going to the bank to get a loan in order to start a business. (About half our group had received business advice prior to visiting with me). Disturbingly, it's not solely uninformed advisors like family and friends or self-interested advisors like banks and accountants who proffer this advice, but advisors like the Small Business Administration, countless non-profits, and even those free "grant" programs (as cited in our analysis of such programs).

Entrepreneurs familiar with alternative forms of funding such as private equity and friends and family were surprisingly scarce in our group, but should they resort to borrowing, they at least were familiar with how to manage the debt. Less informed entrepreneurs, which represents the lifestyle entrepreneurs - the largest class of entrepreneurs - are lead to believe that the only way to realize their misnomered "dream" is to borrow - heavily - on any collateral they have, preferably a home or money in the bank. No surprise here, of course, unless we suppose that if this isn't the best way to launch a business, at least half of all entrepreneurs are receiving very imprudent advice on launching their businesses.

Let's start with what every entrepreneur is told they need prior to getting a loan: a business plan. We already know that not every class of entrepreneur wants money, so why is everyone then told to create a business plan?

Out of all our entrepreneurs, 71% did not want a business plan, nor help putting one together. (See figure 3). What's more, out of our lifestyle entrepreneurs, whether or not they had or even wanted resources, 73% did not want a business plan or help putting one together, either.

So, if they don't want one, why are they advised to put one together so consistently? Particularly if no entrepreneur wants a loan, since no entrepreneur wants to start out with this much (secured) debt and they have alternatives to bank loans? The point isn't simply to bring to light one of the potentially biggest traps (or fraudulent pieces of advice) for entrepreneurs, but to re-assure entrepreneurs, particularly those that don't want to waste time or effort putting one together, that a business plan isn't necessary to transition between levels of entrepreneurship, nor to be an entrepreneur.

|

|

On

Track

|

Despite this, there are certainly cases where a plan would be advantageous to structure an entrepreneur's thoughts and goals. And should an entrepreneur seek funding from a source that requires a business plan, then it certainly makes sense. But one has to question the consistency with which a business plan is suggested without first understanding what the entrepreneur's needs really are and consequently, what options are available for him or her.

The Life of an Entrepreneur

After no less than twelve meetings over the course of 4 months, German has successfully transitioned from a Level 1 to a Level 4 entrepreneur, during which he created a 100-page monster of a business plan (for his own use), all in Spanish - a staggering accomplishment, considering he doesn't own a computer, and a task which he jumped into with the enthusiasm of a little boy in a toy store in an effort to educate himself on his business venture - and in the process, visited banks and commercial lenders for funding. He even dragged his sister into his entrepreneurial mania, which she whole-heartedly committed herself to out of his sheer enthusiasm. He is a confirmed lifestyle entrepreneur (with a dash of serial). And he is no longer depressed. (He still dresses like a bachelor, to put it mildly.)

Regrettably, due to the language barrier, he's been unable to find a bank loan (a symptom of redlining of a different sort) but remains enthusiastic since he now knows what he's doing and his options. Although still anxious to get to work for himself, he understands that entrepreneurship is a sacrifice, one he's not scared to make. He didn't set out to be sexy or have a sexy business. He merely set out to survive. And thanks to his experience, and your reading about it, he's helping many others like him, Hispanic, Black, White, Asian, legal and illegal, succeed in launching not their "dream", but realizing their ambition and abilities in a world that often doesn't properly value either.

Footnotes

(1) "Inside the World of "Free Consulting" and How Your Entrepreneurial Dream May Suffer: A Practical Framework to Advising Entrepreneurs", http://www.alberrios.com/c/0606entrepreneur.html

(2) "Cloudy Job Prospects: Why Entrepreneurship and Not Leadership Is Critical in Transitioning Economies", http://www.alberrios.com/c/0806econ.html

(3) 2002 SURVEY OF BUSINESS OWNERS (SBO), http://www.census.gov/csd/sbo/characteristics2002.htm

(4) "Fixing HR:

An Economic Analysis of 30 Thought Leaders' Best Practices + Detailed Blueprint

for the New Economy", http://www.alberrios.com/c/1005research.html

Al Berrios is Managing Director of al berrios & co., a pure strategy consulting firm, specializing in advising organizations + entrepreneurs on managing their enterprises in a service economy. Write or Subscribe to Consumer Strategies Report.

|

|